Accra, Sept 30, GNA – The Ghana Revenue Authority (GRA) has urged business owners to register with the Authority and issue Value Added Tax (VAT) invoices to avoid prosecution.

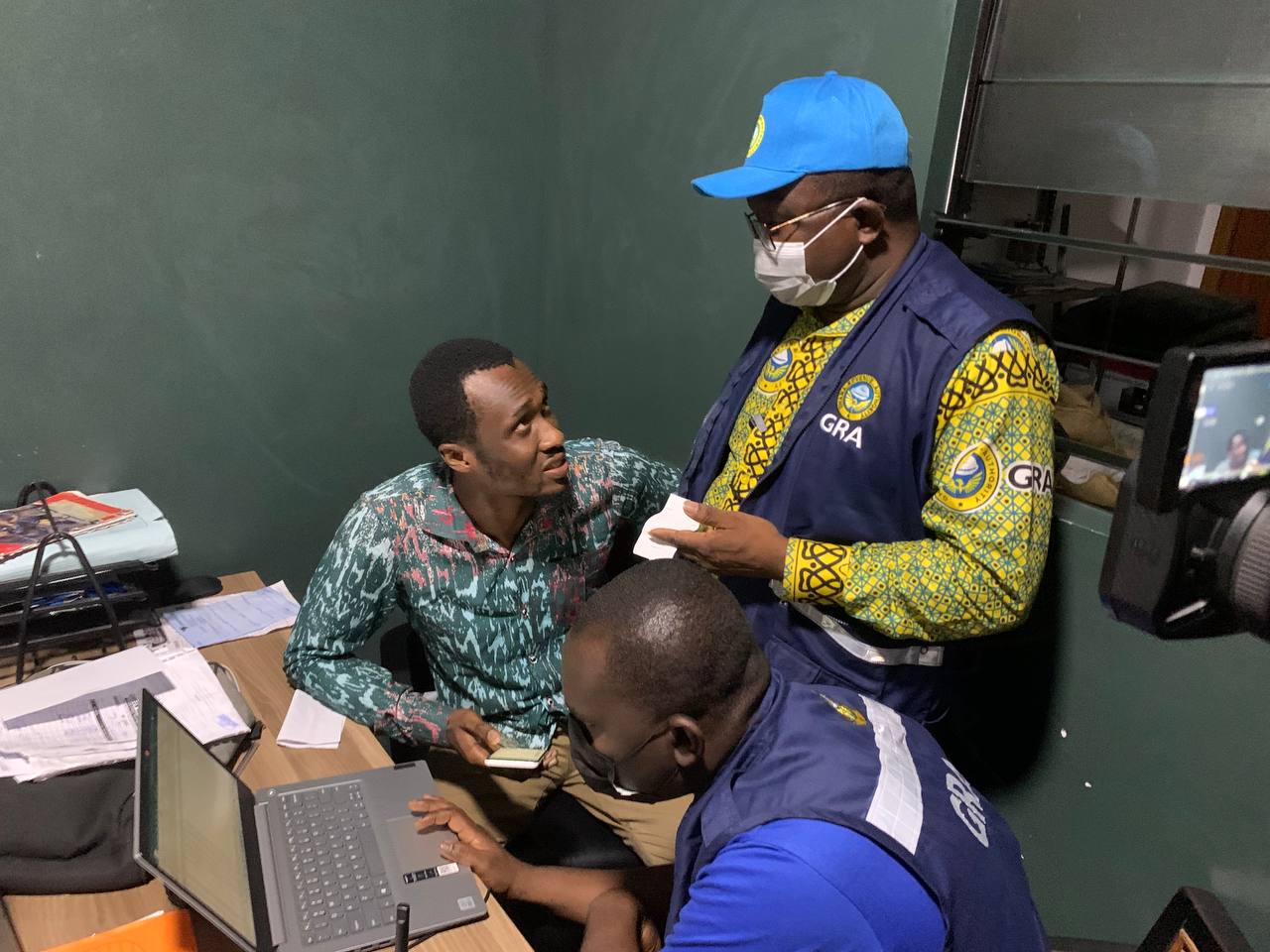

The warning comes after the Authority continued with its ongoing nationwide VAT Invigilation exercise, targeting businesses that operate in the night and did not issue VAT invoices.

In line with the exercise, the enforcement team on Friday evening visited Alley Bar located in Osu in the Greater Accra Region.

In an interview with the Ghana News Agency, Mr Joseph Annan, Area Enforcement Manger of GRA in charge of Accra Central, advised all businesses to register because the penalty or payments for non-registration was much more than what they would pay when registered.

He also said once they were registered to charge VAT then they were mandated by Section 41 of the VAT Act, authorizing them to issue the VAT invoice or an appropriate invoice sanctioned by the Commissional-General.

« Business owners found culpable will be assessed preemptively to pay immediately and handed over to the legal Department of the Authority after Police Investigations for prosecution to pay, » he added.

He said, “the payment made preemptive is considered as payment in advance and it will be taken out of the liability that will be established after the full audit, the difference will be paid by the tax payer. »

Mr Annan said failure to appear at the Office would guarantee a physical arrest because they had taken inventory of what they were accumulating to their Office.

He said the test purchase exercise would continue until some sanity was brought into the system.

The Area Enforcement Manger said the exercise would be taken both in the morning and evening and that they had a tall list of businesses, which are not paying their taxes.

The Authority said it is a criminal offence against the tax laws not to issue the tax invoice.

The exercise or operations are part of an ongoing nationwide VAT Invigilation exercise by the Authority to retrieve some taxes due the State.