Accra, Dec. 05, GNA – Government says it will take all appropriate measures to safeguard the solvency of the financial institutions involved in the Ghana’s domestic debt exchange.

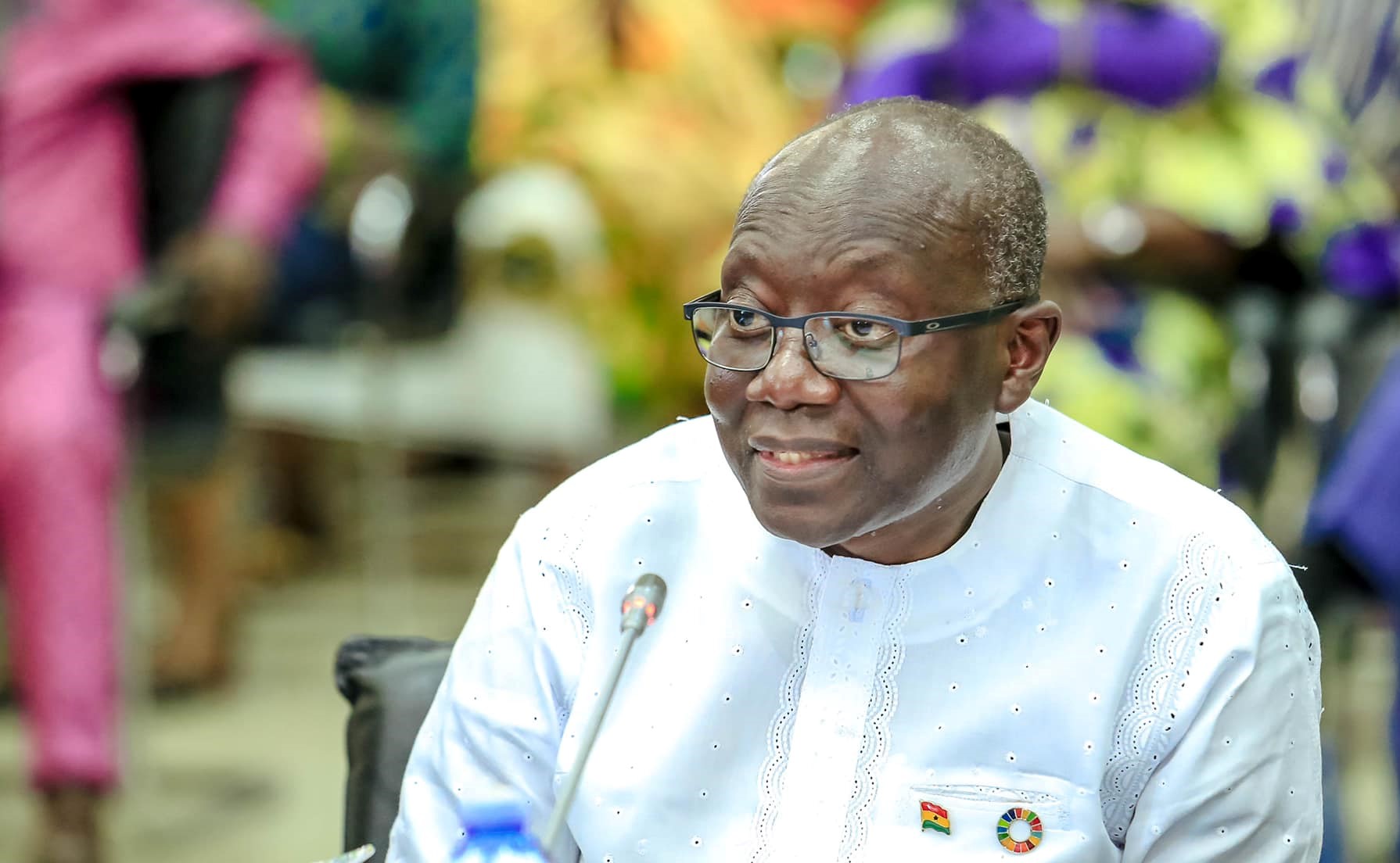

Mr Ken Ofori-Atta, the Minister of Finance, said thanks to well-targeted regulatory measures and the creation of a Financial Stability Fund (FSF), banks, pension funds, insurance companies, fund managers, and collective investment schemes would be supported, to ensure that they meet their obligations to their clients as they fall due.

Mr Ofori-Atta made the pledge during the official launch of Ghana’s domestic debt exchange programme in Accra on Monday.

The programme is to alleviate the debt burden in a most transparent, efficient, and expedited manner.

He said in this context, by means of an exchange offer, the Government had been working hard to minimize the impact of the domestic debt exchange on investors holding government bonds.

“It does not embed any principal haircut on Eligible Bonds, as we promised. Let me repeat this fact as plainly as I can, in this debt exchange individual holders of domestic bonds are not affected and will not lose the face value of their investments,” he said.

He urged Ghanaians to remove any doubt and discard any speculation that the Government was about to cut their retirement savings or the notional value of their investments.

The Minister said for this reason, the Governor of the Bank of Ghana would follow suit with details of the necessary assistance in due course.

“We have also dialogued extensively with regulators across the Financial Sector including Securities and Exchange Commission, National Insurance Commission and National Pensions Regulatory Authority to agree that regulatory forbearance will be provided to all entities whose financial position is adversely affected by virtue of participating in this exchange,” he added.

He said the debt exchange provided an orderly way to put the economy back on track and these efforts would be complemented by fiscal measures to protect the neediest and most vulnerable in society.

Mr Ofori-Atta said the Government expected overwhelming support to this exchange and the success of this necessary endeavour depended on the public’s cooperation.

He called on the media to support the Government in disseminating the right information to economic actors, saying “we are all in this together and we intend to get out of this together.”